Total Cost of Ownership: A Multifaceted Burden

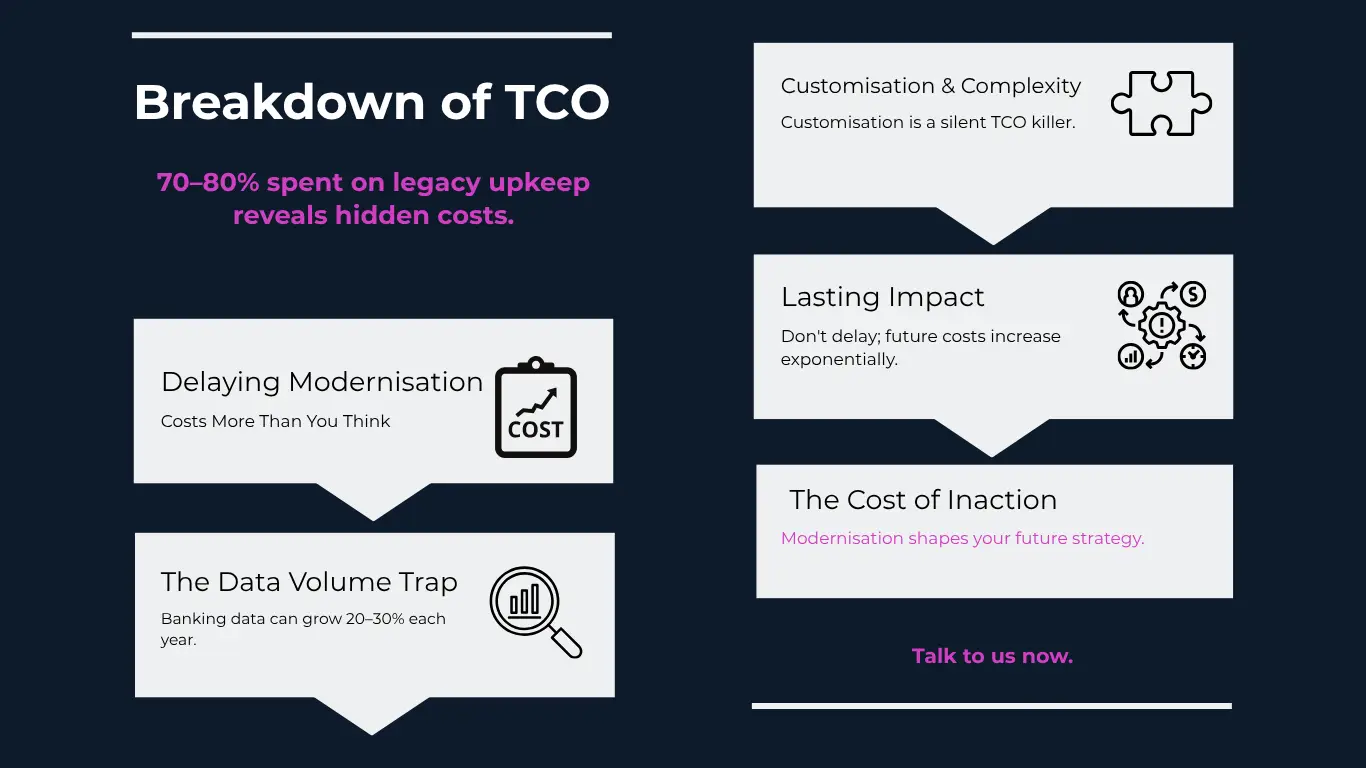

The total cost of ownership (TCO) for legacy banking systems is a complex and escalating burden that extends well beyond simple licensing, hardware, or even maintenance. TCO encompasses ongoing support, compliance, integration, opportunity costs, and, critically, customisation and data management. In modern banks, 70–80% of the IT budget is typically consumed by supporting these aging systems, leaving little for innovation or growth.

Maintenance costs alone can rise by 10–15% annually as systems age and as regulatory and business demands grow.

Time is Money: The Data Volume Trap

A frequently underestimated factor in system modernisation is the exponential growth of data. Every month a legacy system remains in operation, the data pool expands often dramatically, due to new transactions, customer records, regulatory logs, and more. The larger the data pool, the more complex (and expensive) the migration process becomes, particularly because data structures rarely match between old and new systems. Data transformation is not a simple “lift-and-shift”; it requires deep analysis, quality checks, and often manual intervention to ensure compliance and business continuity.

The founder of Digital Bank Expert emphasised that “every time they do postpone the replacement, they do make that situation even worse, because at the later stage, the replacement will [be] way more [expensive] than it might be.” This is not just about software licenses; it’s about the spiraling costs of data migration, which may account for 30–50% or more of the total cost of a modernisation project if left unaddressed for too long.

Customisation and Integration: The Hidden Cost Center

One of the most significant drivers of TCO in banking IT is the cost of customisation and integration. Banks rarely operate a single system; instead, they typically run between 20 and 40 different ancillary systems (for payments, risk, compliance, CRM, etc.), each of which must be integrated and often customised to work with the platform.

Customisation is not a one-off expense. Every regulatory change, product launch, or market shift may require further modifications, driving up costs and increasing technical debt. Integration complexity is compounded by the need to maintain real-time data flows, consistent user experiences, and robust security across all systems. This is why customisation and integration are often the most expensive and risky parts of modernisation, sometimes accounting for the majority of the project budget.

Loss of Competitive Edge: The Price of Technological Inertia

Banks that delay modernisation, not only face ballooning TCO and migration costs, but also risk a profound loss of competitive edge. The financial industry is being reshaped by digital-first challengers and fintechs who can innovate rapidly, launch new products quickly, and deliver seamless, omnichannel experiences.

Legacy-bound banks, by contrast, struggle to support real-time payments, API-driven ecosystems, and mobile-first customer journeys. As a result, they risk losing market share, customer trust, and even regulatory compliance. Recent industry data shows that banks leading in digital transformation are growing market share at the expense of those stuck on legacy platforms.

The Digital Bank Expert founder summarises it as: “Technology is one of the biggest competitive advantages in the market. Just look at digital banks that didn’t exist a few years ago, but are now major players.”

The Escalating Challenge of Data Migration

Data migration is often the most underestimated and critical phase of system modernisation. As data volumes increase, so does the complexity of transformation. Mapping, cleansing, validating, and reconciling data across dozens of systems. The cost of data migration can double or triple if left unaddressed for years, as legacy data accumulates errors, inconsistencies, and non-standard formats.

In practice, 99% of the attention in modernisation projects is required for data migration, not just the installation of new software. The longer a bank waits, the more data must be transformed, and the more costly and risky the process becomes.

The Strategic Imperative to Act Now

The message is clear and urgent: banks that delay modernisation are not just accruing technical debt, they are actively eroding their own competitiveness and increasing future costs. The TCO of legacy systems is a moving target, driven ever higher by maintenance, customisation, integration, and above all, the relentless growth of data.

Application Lifecycle Management (ALM) is a critical consideration, requiring banks to maintain a clear and up-to-date overview of the status of each application within their technology landscape, spanning evaluation, implementation, live operation, phasing out, and retirement. Regular reviews of every application are essential to assess ongoing business and technical fit, as these criteria inevitably evolve over time. Proactive planning of replacements and migrations should be embedded within a robust, forward-looking schedule to ensure operational continuity and regulatory compliance.

Digital Bank Expert supports financial institutions across all facets of ALM, including comprehensive IT audits, structured replacement scheduling, new platform sourcing and implementation, seamless data migration, and the transition of business processes. Our deep expertise enables banks to optimise their technology portfolio efficiently, maximise value, and remain agile in an ever-changing digital landscape.

Modernisation is not just an IT project; it is a strategic transformation that determines whether a bank will thrive or fall behind in the digital era. The time to act is now, before the costs, in money, data, and market position become insurmountable.