Why ISO 20022 Matters for Low-Value Payments

Most people associate ISO 20022 with wholesale rails. That misses the real story for operators that live and breathe retail volume. If you authorise, clear and settle millions of card and wallet transactions every day, the constraint is not gross value. The constraint is data quality at line speed. ISO 20022 is your opportunity to fix that constraint while keeping latency low and reliability high.

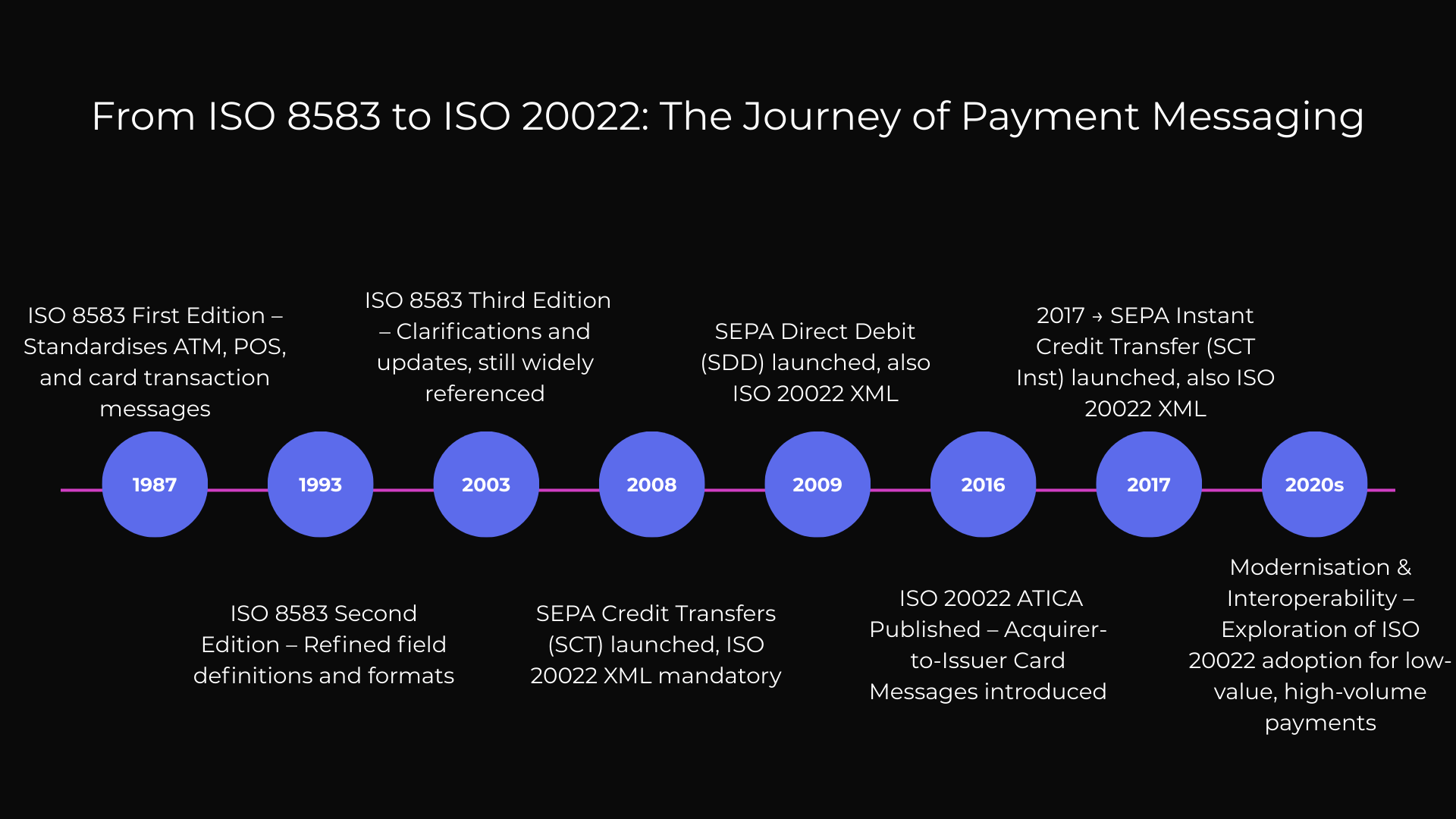

Cards have lived for decades on ISO 8583. It is elegant in its own way, but it is flat and positional. Fields are overloaded, remittance is sparse, addresses are often free text, and important context rides in proprietary extensions. When volume is enormous, these limitations create cost. Exception queues grow. Reconciliation gets rekeyed. Fraud engines are fed ambiguous signals. You can maintain this status quo, or you can move to a language that was designed to carry richer meaning without breaking throughput. That is the promise of ISO 20022 in the low-value domain.

The cards community is not waiting for someone else to define how ISO 20022 should be used. Under ISO’s governance, the industry has been developing Acquirer to Issuer Card Messages, known as ATICA. ATICA covers authorisation, verification, clearing, settlement and reporting across the acquirer to issuer domain. It is designed to replicate necessary ISO 8583 semantics where required, while introducing structured fields that allow automated validation, better analytics and more precise risk controls. Critically, ATICA recognises that coexistence with 8583 is necessary for some time, so the migration model is pragmatic rather than purist.

Visa and Mastercard Perspectives

Visa has been a visible voice in this journey. Its research arms have published accessible explanations that demystify ISO 20022 for cards and set out why structured fields matter in authorisation pipelines that cannot afford extra milliseconds. In markets like Australia, Visa has also supported regulator consultations and encouraged harmonised use of the most current version of ISO 20022 so ecosystems avoid fragmentation. That is not marketing. Harmonisation is the difference between a single lift and a patchwork of bilateral adaptations.

Mastercard has argued a complementary point. Domestic retail systems are rarely mandated to adopt ISO 20022, but the commercial logic is compelling when participants want cross-border connectivity, richer data for analytics, and alignment with real-time schemes. Migration is a strategy choice, not a penalty avoidance exercise. For low-value operators, that framing is liberating. It means you can target the benefits that matter most in your market rather than ticking a wholesale box.

ISO 20022 as a Data Product

What does this mean in practice? It means treating ISO 20022 as a data product, not as a format. The product has customers. Operations want fewer breaks and faster investigations. Finance wants zero manual reconciliation. Risk wants fewer false positives. Product teams want structured merchant and purpose data they can mine without hand-crafting parsers for every acquirer. The way to meet those needs is to preserve semantics end to end. If you receive a structured merchant address and identifier, do not compress it into a free text blob in downstream systems. If the scheme sends a category purpose or a transaction risk parameter, expose it to your fraud models. Structure only pays if you keep it intact across the journey.

There are already live examples that point the way. Real-time retail payment systems that adopted ISO 20022 from day one report better automation in reconciliation and higher data quality in compliance workflows. Schemes that modernised their APIs on ISO 20022 principles use richer messages without measurable impact on end-to-end latency. Card processors piloting ATICA-aligned fields in authorisation have demonstrated that hybrid mappings can run safely alongside 8583 while enabling new analytics use cases. These are not headlines that belong only to wholesale. They are proof points that low-value systems can be fast and intelligent at the same time.

How Digital Bank Expert Helps

Digital Bank Expert is built for this problem. Our teams design canonical models that respect ATICA semantics, wrap legacy 8583 without losing meaning, and feed structured data into risk, finance and customer platforms. We build test harnesses that measure round-trip latency and break rates with and without enrichment, so you can make decisions on evidence. We guide operators to harmonise not just formats but also business rules, so optional fields are used consistently across acquirers and issuers. The goal is simple. Keep your throughput, lift your data.

Leaders start with why. Here it is. ISO 20022 is not an IT upgrade. It is the way value now speaks across the world’s payment systems. Speak it fluently, and you gain speed, control and credibility. Delay, and the world speaks past you.

The way you talk about ISO 20022 inside your organisation matters. If you talk about a format, you will buy a converter. If you talk about a data product, you will redesign how you operate. The first path keeps you compliant. The second path compounds benefits. That is how low-value leaders win the next decade of payments.

Related Articles

Bibliography

- Visa Economic Empowerment Institute. “Demystifying ISO 20022.” 2022. Visa

- Visa submission to the Reserve Bank of Australia. “ISO 20022 Migration for the Australian Payments System.” 2019. Reserve Bank of Australia

- Mastercard Insights. “ISO 20022: is it a must have for domestic payments processing.” 2024. Mastercard

- Mastercard. “Getting the message across: ISO 20022 data standards.” Dec 2023. b2b.mastercard.com

- Mastercard. “What is next for real time payments.” 2024. Mastercard