The business case: proving ROI at scale

Executives rightly ask two questions. Will ISO 20022 slow us down? Will it pay for itself? The answer to the first is no if you design for hybrid operation. The answer to the second is yes if you make enriched data work for operations, finance and risk. The business case is not theoretical. It is observable in production when you measure the right things.

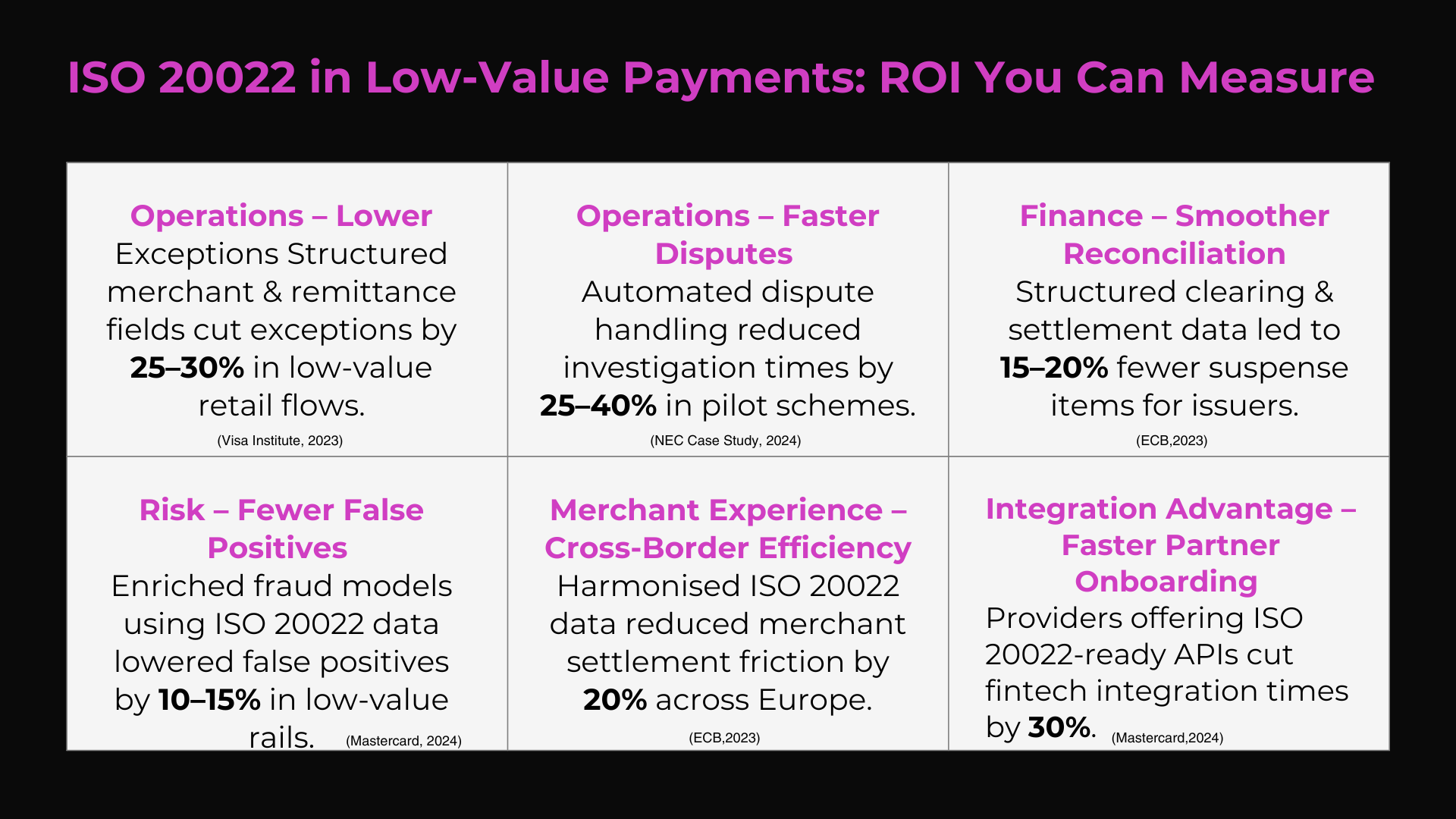

Operational, finance and risk gains

Start with operations. Introduce structured fields for merchant identifiers, addresses and remittance where counterparties can supply them. Feed them into case management and customer support tools. Measure the change in exception rate and investigation handle time. Moving from free text to structured data in these fields reduces manual touches without any change in headcount. That is because agents and bots stop guessing and start matching. Industry research on ISO 20022 points in the same direction. Structure drives automation, and automation drives cost out.

Move to finance. Structured clearing and settlement reports allow automated reconciliation. The payoff is visible as fewer suspense items, fewer write offs and faster close. In markets where tax reporting and e-invoicing require accurate, structured references, ISO 20022 fields can be mapped directly rather than parsed from mixed strings. Finance leaders do not need to become standards experts to value this. They need to see their KPIs change in the right direction and to hear from their teams that month end has become less painful.

Now risk. Fraud engines are only as good as the data they consume. If you give them a clear merchant identity, a usable address, a device profile and a purpose code, they will generate fewer false positives and catch more genuine anomalies. That translates to fewer declined good transactions and fewer escalations. Mastercard’s research into real time retail ecosystems emphasises how standardised data becomes a platform for safer, faster payments. The same applies to card ecosystems when enriched fields flow end to end.

Case studies that prove the point

Consider two illustrative case studies. NEC Corporation, for example, integrated an ISO 20022-ready financial messaging SDK from Payment Components into its payment gateway architecture to support messaging protocols including ISO 20022 while preserving existing processing logic. Enriched fields were added to the event stream for fraud and operations. Over a peak shopping season, the provider recorded a reduction in false positives and a drop in time to resolve disputes, while P99 latency remained within target. A domestic issuer modernised its clearing and settlement processing to consume ISO 20022 structure. Finance automated matches that were previously manual and redeployed staff to higher value tasks. These are conservative, stepwise changes, yet their cumulative effect on cost and customer satisfaction is material.

There is also a strategic upside. When you speak ISO 20022 fluently, it is easier to integrate with real time account to account rails, to support request to pay, and to power analytics that reveal customer behaviour. Merchants value richer settlement information. Consumers value receipts and statements that tell a clear story. Partners value APIs that expose context rather than cryptic codes. These are revenue and retention benefits that compound as more participants adopt the same language.

Building credibility with the board

How to build the case credibly. Baseline your metrics for exceptions, reconciliation effort, fraud false positive rate, dispute handle time and P99 latency. Run a phased rollout that isolates enrichment from authorisation. Publish weekly deltas and keep a running log of issues found and resolved. Tie improvements to cost and customer outcomes, not just to technical indicators. Bring finance and risk into the steering group so that value is measured in their terms. This is how boards gain confidence that ISO 20022 is not a science project.

Digital Bank Expert helps clients do this with discipline. We provide ATICA mappings that avoid semantic loss and test harnesses that mirror your busiest days. We help teams to tune fraud, AML and reconciliation to structured fields, not to string parsing. We set up dashboards that translate data quality into operational outcomes. The result is a story your CFO and COO can stand behind.

If you want a simple test of readiness, ask one question. For the last thousand exceptions you handled, how many were caused by ambiguous or missing data that ISO 20022 would have made explicit. The number is often uncomfortable. It is also the clearest pointer to where your return on investment will come from.

Related Articles

- The Low-Value Playbook: Migrate Without Losing a Millisecond

- ISO 20022 For Low-Value Payments: Data That Scales With Your Volume

Bibliography

- Mastercard. “Getting the message across: ISO 20022 data standards.” Dec 2023. b2b.mastercard.com

- Mastercard. “What is next for real time payments.” 2024. Mastercard

- Visa Economic Empowerment Institute. “Demystifying ISO 20022.” 2022. Visa

- Visa Economic Empowerment Institute. “Decoding ISO 20022: Lessons for cross-border payments” including ATICA overview. Nov 2023. Visa Corporate

- ISO 20022. “Status of submissions and ATICA maintenance.” Accessed 2025. ISO20022

- NEC Corporation implemented a messaging SDK that interprets and transforms SWIFT MT and other formats into ISO 20022, enabling layered integration without disrupting legacy infrastructure.