Building the foundations

Low-value modernisation succeeds when two truths are held at once. The first is that retail payments value speed and reliability. The second is that richer data makes everything better. The playbook below is what we use with issuers, acquirers and processors who want to add structure without adding friction.

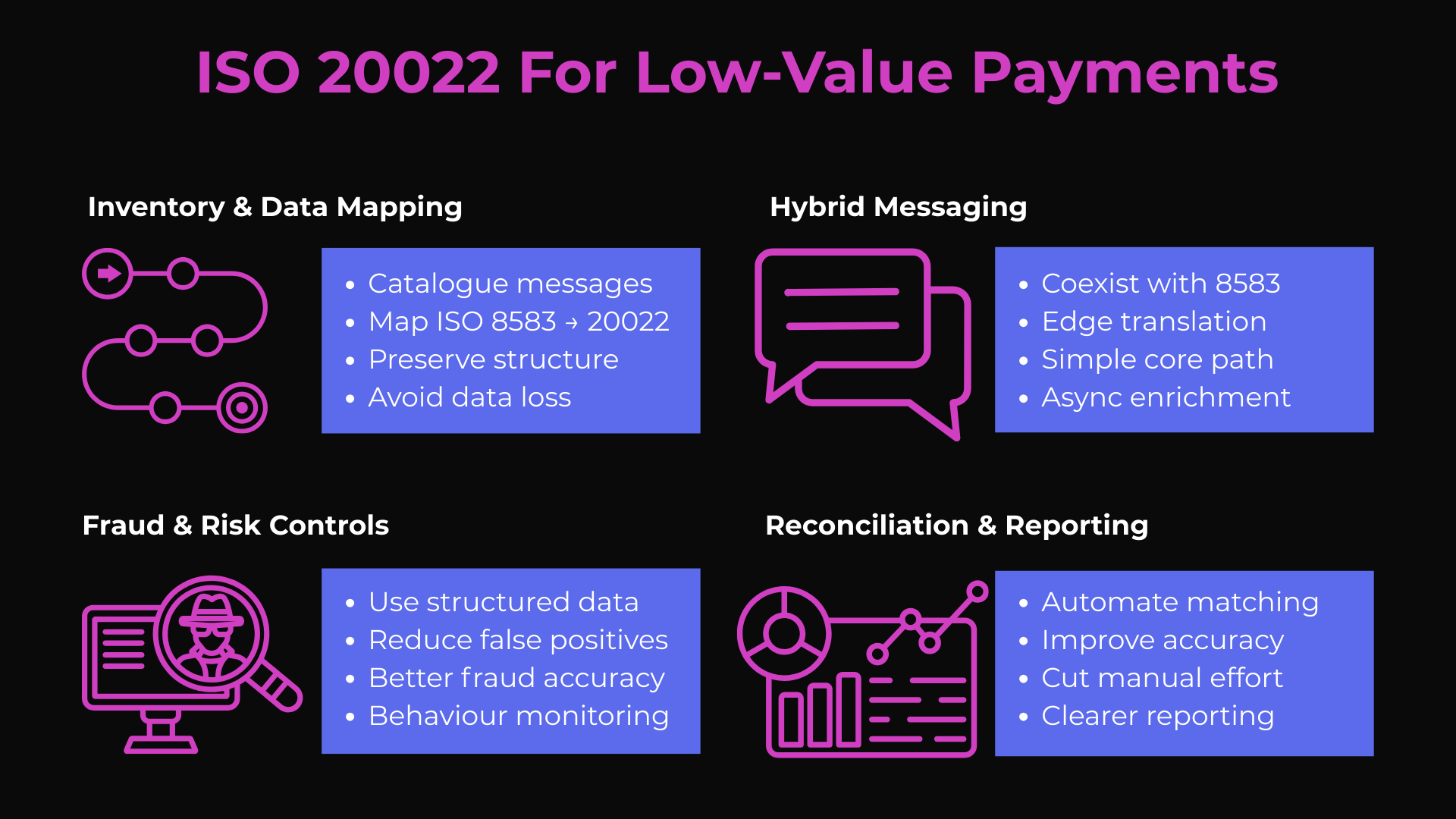

Begin with the inventory. Catalogue every authorisation, clearing and settlement message in scope. For cards, that means mapping ISO 8583 fields and any private data elements to ISO 20022 concepts, prioritising ATICA coverage. Establish where you will carry structured merchant data, device identifiers and transaction attributes, and where you will keep unstructured content for backward compatibility. The principle is to avoid lossy transformations. If you can safely carry a structured field, do it. In low-value payments, the focus is on feeding fraud and risk engines with precise merchant and transaction data that reduces ambiguity.

Design a canonical data model. This is not glamorous, yet it decides your outcome. Model merchants, cardholders, devices, addresses and remittances in line with ATICA so that richness persists beyond the gateway. If you compress structure at the edges, downstream systems will never see the benefit. Align your event schema with the fields risk, finance and customer teams most need. Visa and Mastercard guidance is clear that the business benefits of ISO 20022 come from increased data fidelity, not from the label on the wire.

Adopt hybrid messaging by design. Coexistence with ISO 8583 is a fact for many markets. Build an adapter that translates to and from ATICA while preserving semantics. Where performance is sensitive, confine translation to the edges and keep the core real time path as simple as possible. Use asynchronous enrichment for fields that are not required to make an authorisation decision. This pattern keeps your P99 latency stable and your throughput predictable even as you add structure.

Using data for impact

Refresh your controls. Richer ISO 20022 data allows fraud models to use additional context such as merchant category, purpose codes and device fingerprints. This is where structured fields add practical value: fewer false alerts caused by ambiguous text and better distinction between genuine unusual behaviour and malicious activity. In practice, this means that operational teams spend less time chasing false alarms and more time addressing the real cases.

Modernise reconciliation and reporting. Structured remittance and merchant identifiers allow automated matching of settlement files, acquirer statements and issuer postings. Finance teams should see a measurable drop in manual effort and adjustments. Where merchants send enhanced data, pass it through to receipts and dashboards so customers and sellers both get clarity. This is where operators start to quantify return on investment beyond technology metrics.

Test like an operator, not like a lab. Build golden datasets with real-world edge cases. Include long merchant names, complex addresses, international characters, fallbacks and dispute scenarios. Run volume tests that reflect your peak shopping events. Track latency deltas with and without enrichment and publish the numbers to your sponsors so they understand the trade offs they did not have to make.

Learning from real-world examples

Learn from adjacent markets. Real-time retail payment schemes that adopted ISO 20022 natively show what is possible. For example, the UK’s Faster Payments Programme and Australia’s New Payments Platform both report faster reconciliation and higher-quality data for fraud detection and analytics. In Australia, the NPP’s use of structured data fields has allowed banks to deliver overlay services like PayID and Request-to-Pay, demonstrating how richer standards create space for innovation beyond basic transfers. While cards and instant account-to-account schemes differ, the lesson for low-value is consistent: structured data improves automation without slowing the system. Mastercard’s research on real-time payments has shown how standards enable ecosystem-wide services when everyone uses them consistently.

Two short case studies illustrate what good looks like. A regional acquirer introduced an ATICA-aligned adapter at the gateway, kept its core authorisation path untouched, and fed structured merchant and address fields to fraud and reconciliation. Within three months, false positives fell and exception queues shrank even though traffic grew. A digital issuer moved clearing and settlement reporting to ISO 20022 structure without changing authorisation. Finance cut manual match effort and chargeback investigation time. These are practical, incremental wins that scale.

Digital Bank Expert’s role is to make this predictable. We bring ATICA mappings, low-latency adapters, test harnesses that hammer your peak volumes, and operating model blueprints that put structured data to work in fraud, AML and finance. The outcome is simple. Keep your millisecond budget. Lose your ambiguity budget.

Related Articles

Bibliography

-

- Visa Economic Empowerment Institute. “Decoding ISO 20022: Lessons for cross-border payments” including ATICA overview. Nov 2023. Visa Corporate

- Visa Economic Empowerment Institute. “Demystifying ISO 20022.” 2022. Visa

- Mastercard. “Getting the message across: ISO 20022 data standards.” Dec 2023. b2b.mastercard.com

- Mastercard. “What is next for real time payments.” 2024. Mastercard

- Mastercard Insights. “ISO 20022 for domestic payments.” 2024. Mastercard

- The Banker. “How UK Faster Payments Changed The World”

- New Payments Platform Australia. “The New Payments Platform” RBA

-

Reserve Bank of Australia. New Payments Insights from the Updated Retail Payments Statistics Collection Bulletin, March 2019.