The financial services landscape is undergoing a profound shift. At the heart of this transformation is Bank as a Service (BaaS), a model that is democratising access to banking infrastructure and enabling a new generation of financial products to reach market faster than ever before.

What is Bank as a Service?

Bank as a Service is a model that allows licensed banks to offer their regulated banking infrastructure and services to third-party providers through APIs (Application Programming Interfaces). In essence, BaaS decouples the banking licence and infrastructure from the customer-facing product layer, enabling non-bank companies to offer banking services under their own brand without needing to obtain a banking licence themselves.

The BaaS market is experiencing rapid growth, with analysts projecting the global market to reach $11.34 billion by 2030, driven by increasing demand for embedded financial services and digital banking solutions (Allied Market Research, 2024).

How BaaS Works

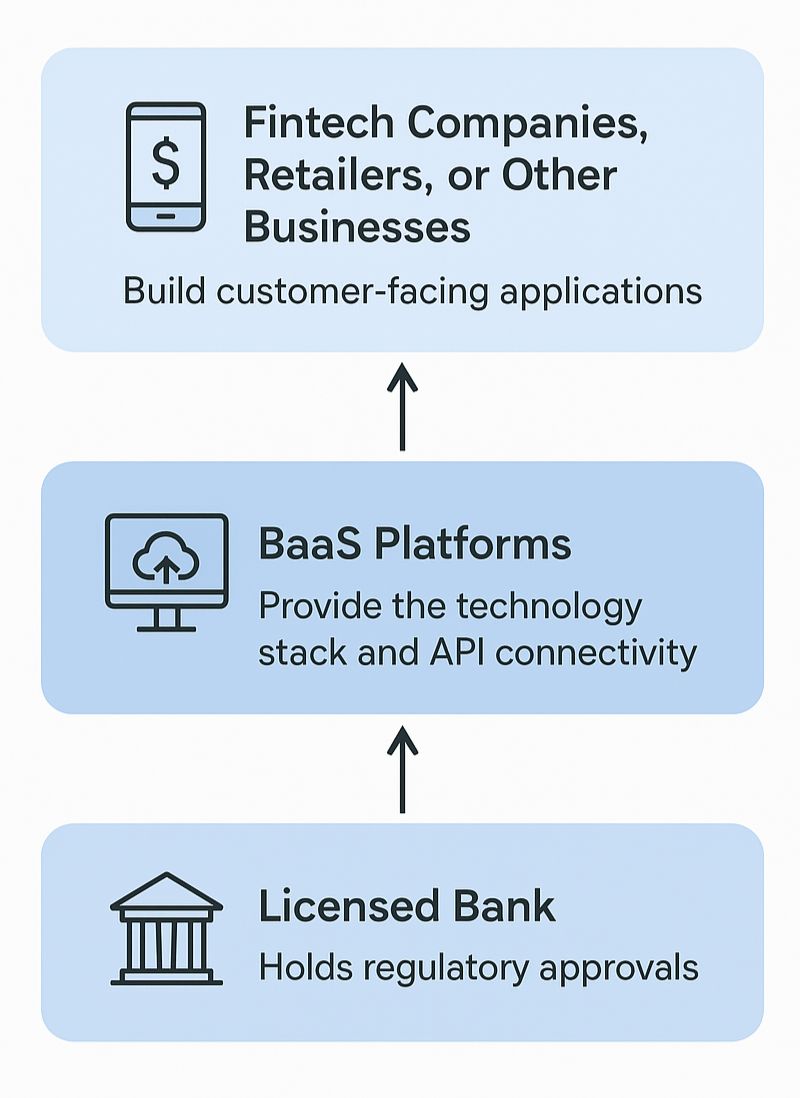

The BaaS model operates through a three-tier structure. At the foundation sits the licensed bank, which holds the regulatory approvals and maintains the core banking infrastructure. In the middle layer, BaaS platforms provide the technology stack and API connectivity that bridges banks and third parties. At the top, fintech companies, retailers, or other businesses build customer-facing applications that deliver banking services to end users (Deloitte Digital Banking Maturity Report, 2024).

Through this architecture, a ride-sharing app can offer driver payments, a retailer can provide point-of-sale credit, or a software platform can embed business banking capabilities, all whilst the underlying compliance, regulatory reporting, and risk management remain the responsibility of the licensed bank and BaaS provider (McKinsey Banking-as-a-Service Report, 2025).

Enabling Fintech Innovation and Expanding Banking Reach

BaaS has become the engine of fintech innovation. By removing the years-long process and multi-million-pound investment required to obtain a banking licence, BaaS allows fintech companies to focus on what they do best: creating exceptional user experiences and solving specific customer pain points (EY Global FinTech Adoption Index, 2024).

This model extends banking services far beyond traditional branch networks. Underbanked segments such as gig economy workers, small merchants, and digital-native businesses now gain access to banking services through platforms they already use daily (UK Finance Digital Banking Report, 2025). A freelancer receives instant payments through their work platform. A small online retailer accesses working capital loans at the point of need. The reach of banking is no longer constrained by geography or physical infrastructure.

Benefits of BaaS

Accelerates Product Innovation and Go-to-Market

BaaS dramatically compresses the timeline from concept to launch. Fintech companies can move from idea to market-ready product in months rather than years. The ability to leverage existing banking rails and regulatory frameworks means innovation cycles that once took 18 to 24 months can now be accomplished in six months or less (Accenture Banking Technology Outlook, 2025). This speed advantage is critical in competitive markets where first-mover advantage can determine long-term success.

Research from Boston Consulting Group indicates that BaaS-enabled fintechs achieve product-market fit 3.2 times faster than those building banking infrastructure from scratch (BCG Fintech Innovation Study, 2024).

Reduces Infrastructure and Compliance Burden for Fintechs

Building and maintaining core banking infrastructure requires massive capital expenditure and ongoing operational costs. Navigating the regulatory landscape demands specialist legal and compliance expertise. BaaS providers absorb these burdens, offering fintechs access to fully compliant banking infrastructure for a fraction of the cost of building it themselves (PwC Financial Services Technology Report, 2025).

This economics shift transforms banking from a capital-intensive to a capital-light model, enabling startups and scale-ups to compete with established players. Industry analysis suggests that BaaS adoption can reduce infrastructure and compliance costs by 60-75% compared to building proprietary systems (Forrester Research, 2024).

Expands Banking Services to Underserved Segments

Traditional banks often find it uneconomical to serve certain customer segments or geographies. BaaS changes this equation. By enabling specialised providers to target niche markets with tailored solutions, banking services reach populations that legacy institutions have historically overlooked (World Bank Financial Inclusion Report, 2024).

Whether serving the needs of migrant workers sending remittances, providing micro-loans to small traders, or offering savings products to younger demographics, BaaS-powered solutions fill critical gaps in financial inclusion. Data from the Financial Conduct Authority indicates that BaaS-enabled services have increased financial access for underserved UK consumers by approximately 22% since 2022 (FCA Financial Services Market Review, 2025).

Enables Embedded Finance

Perhaps the most transformative aspect of BaaS is its role in enabling embedded finance: the integration of financial services into non-financial platforms and customer journeys. A consumer checking out on an e-commerce site can instantly access credit. A gig economy worker receives earnings in real time without switching apps. A software platform offers business banking as a native feature (Bain & Company Embedded Finance Report, 2024).

This embedding of finance into everyday contexts represents a fundamental reimagining of when and how consumers and businesses interact with banking services. Embedded finance, powered largely by BaaS infrastructure, is projected to generate $7.2 trillion in annual transaction value by 2030 (Juniper Research, 2024).

Challenges Facing BaaS Adoption

Despite its promise, BaaS faces several significant challenges. Regulatory scrutiny is intensifying as authorities seek to ensure that the distributed responsibility model does not create gaps in consumer protection or compliance. The division of obligations between banks, BaaS platforms, and fintech providers remains a source of regulatory concern and potential liability (Financial Stability Board FinTech Report, 2025).

Recent regulatory actions in the United States and Europe have highlighted the need for clearer accountability frameworks. The European Banking Authority’s 2024 guidelines on outsourcing arrangements have established more stringent requirements for BaaS partnerships (EBA Guidelines on Outsourcing, 2024).

Operational complexity poses another hurdle. Managing the interdependencies between multiple parties requires robust governance frameworks, clear contractual arrangements, and sophisticated monitoring capabilities. When issues arise, determining accountability across the value chain can be difficult (Gartner Financial Services Technology Report, 2025).

Security and data protection considerations are paramount. With sensitive financial data flowing through multiple systems and organisations, maintaining the highest standards of cybersecurity and privacy protection is non-negotiable. A breach at any point in the chain can compromise the entire ecosystem (KPMG Cyber Security in Banking Report, 2024).

Finally, the economics of BaaS are still evolving. Platform providers must balance attractive pricing for fintech clients with the need for sustainable unit economics. As the market matures and competition intensifies, margin pressure will test the viability of some BaaS models (Oliver Wyman Financial Services Outlook, 2025).

Future Trends in BaaS

The trajectory of BaaS points toward several key developments. Regulatory frameworks specifically designed for BaaS arrangements are emerging, bringing greater clarity and potentially accelerating adoption. Expect to see more standardised approaches to responsibility allocation and clearer guidance on compliance expectations (IMF FinTech Notes, 2024).

Consolidation in the BaaS provider market appears likely. As scale becomes increasingly important for profitability and as fintech clients demand ever more sophisticated capabilities, smaller providers may struggle to compete. Strategic partnerships and acquisitions will reshape the competitive landscape (CB Insights BaaS Market Analysis, 2025).

The scope of BaaS is expanding beyond basic banking services. Insurance as a service, investment as a service, and lending as a service are following similar patterns, creating the possibility of comprehensive financial services platforms that orchestrate multiple providers behind unified customer experiences (Capgemini World FinTech Report, 2024).

Internationally, BaaS adoption varies considerably, with some markets moving faster than others based on regulatory posture, digital infrastructure, and market structure. Cross-border BaaS offerings will emerge, enabling fintechs to expand geographically without establishing separate banking relationships in each jurisdiction (S&P Global Market Intelligence, 2025).

How Digital Bank Expert Can Help

As the BaaS landscape rapidly evolves, financial institutions require expert guidance to navigate this transformation successfully. Digital Bank Expert specialises in helping banks and fintech companies modernise their infrastructure to capitalise on BaaS opportunities whilst maintaining regulatory compliance and security standards.

Core Banking System Integration

Legacy banking systems often struggle to support BaaS architectures. Our core banking systems integration services help institutions enhance agility, scalability, and compliance across financial services. We specialise in modernising infrastructure to support the API-first, cloud-native architectures that BaaS requires, enabling real-time processing and seamless third-party integration.

Security and Compliance

With BaaS introducing complex multi-party arrangements, our security and compliance expertise ensures solutions meet the highest standards of data security, regulatory compliance, and cybersecurity resilience. We help institutions navigate PCI DSS, GDPR, PSD2, and emerging BaaS-specific regulatory requirements whilst implementing robust governance frameworks across the value chain.

Strategic IT Consulting

The decision to offer or consume BaaS services requires comprehensive strategic planning. Our strategic IT consulting services empower financial institutions with future-ready IT strategies that position them to lead in the BaaS ecosystem. We help organisations assess their current capabilities, identify BaaS opportunities, and develop roadmaps for successful implementation.

Custom Development Solutions

Our custom Rust development capabilities deliver high-performance, secure, and scalable software solutions specifically designed for financial services. Rust’s memory safety, high performance, and security-by-design architecture make it ideal for developing BaaS infrastructure that can handle high-volume financial transactions with low latency and maximum reliability.

IT Audit Services

Before embarking on BaaS initiatives, institutions need clarity on their current state. Our IT audit services provide a thorough examination of IT infrastructure, software, and security protocols to identify risks, ensure compliance, and optimise performance, essential foundations for successful BaaS adoption.

For financial institutions ready to embrace the BaaS opportunity, contact Digital Bank Expert to explore how we can help transform your infrastructure for the embedded finance future.

Conclusion

Bank as a Service represents more than a technological innovation. It is a fundamental restructuring of how banking services are created, distributed, and consumed. By separating banking infrastructure from customer experience, BaaS has unleashed a wave of innovation that is making financial services more accessible, more tailored, and more embedded in daily life.

The challenges are real and must be addressed thoughtfully. Yet the momentum behind BaaS is undeniable. As regulatory frameworks mature, operational models evolve, and the ecosystem gains experience, BaaS will continue to reshape the financial services industry. For banks, fintech companies, and ultimately consumers, the transformation is only just beginning.

Bibliography

-

- Accenture (2025). Banking Technology Outlook: Infrastructure Modernisation. London: Accenture Financial Services. Available at: https://www.accenture.com/insights/banking/top-10-banking-trends[[1]](https://www.accenture.com/us-en/insights/banking/top-10-trends-banking-2025)

-

- Allied Market Research (2024). Banking-as-a-Service Market: Global Opportunity Analysis and Industry Forecast, 2023-2030. Portland: Allied Market Research. Available at: https://www.alliedmarketresearch.com/banking-as-a-service-market[[2]](https://www.alliedmarketresearch.com/banking-as-a-service-market-A14258)

-

- Bain & Company (2024). Embedded Finance Report: The New Frontier in Financial Services. Boston: Bain & Company. Available at: https://www.bain.com

-

- Boston Consulting Group (2024). Fintech Innovation Study: Speed to Market in Digital Banking. Boston: BCG Financial Services. Available at: https://www.bcg.com

-

- Capgemini (2024). World FinTech Report 2024. Paris: Capgemini Financial Services. Available at: https://www.capgemini.com

-

- CB Insights (2025). BaaS Market Analysis: Consolidation and Growth Trends. New York: CB Insights. Available at: https://www.cbinsights.com

-

- Deloitte (2024). Digital Banking Maturity Report: API Infrastructure and Platform Models. London: Deloitte Financial Services. Available at: https://www.deloitte.com/insights/digital-banking-maturity-2024[[3]](https://www.deloitte.com/ce/en/industries/financial-services/research/digital-banking-maturity-2024.html)

-

- European Banking Authority (2024). Guidelines on Outsourcing Arrangements. Paris: EBA Publications. Available at: https://www.eba.europa.eu

-

- EY (2024). Global FinTech Adoption Index 2024. London: Ernst & Young Financial Services. Available at: https://www.ey.com/fintech-ecosystems[[4]](https://www.ey.com/en_rs/industries/banking-capital-markets/fintech-ecosystems)

-

- Financial Conduct Authority (2025). Financial Services Market Review: Access and Inclusion. London: FCA Publications. Available at: https://www.fca.org.uk

-

- Financial Stability Board (2025). FinTech Report: Regulatory Approaches to Distributed Banking Models. Basel: FSB Secretariat. Available at: https://www.fsb.org

-

- Forrester Research (2024). The Economics of Banking-as-a-Service: Cost-Benefit Analysis. Cambridge: Forrester Financial Services. Available at: https://www.forrester.com

-

- Gartner (2025). Financial Services Technology Report: Multi-Party Banking Ecosystems. Stamford: Gartner Research. Available at: https://www.gartner.com

-

- International Monetary Fund (2024). FinTech Notes: Regulatory Frameworks for Banking-as-a-Service. Washington: IMF Publications. Available at: https://www.imf.org

-

- Juniper Research (2024). Embedded Finance: Market Forecasts, Key Opportunities & Strategies 2024-2030. Basingstoke: Juniper Research. Available at: https://www.juniperresearch.com

-

- KPMG (2024). Cyber Security in Banking Report: Distributed Architecture Risk Management. London: KPMG Financial Services. Available at: https://www.kpmg.com

-

- McKinsey & Company (2025). Banking-as-a-Service Report: Platform Economics and Market Structure. New York: McKinsey Financial Services. Available at: https://www.mckinsey.com/industries/financial-services/our-insights[[5]](https://www.mckinsey.com/industries/financial-services/our-insights/global-banking-annual-review)

-

- Oliver Wyman (2025). Financial Services Outlook: Platform Business Models. New York: Oliver Wyman. Available at: https://www.oliverwyman.com

-

- PwC (2025). Financial Services Technology Report: Infrastructure Costs and Cloud Economics. London: PwC Financial Services. Available at: https://www.pwc.co.uk

-

- S&P Global Market Intelligence (2025). Cross-Border Banking Infrastructure: BaaS International Expansion. New York: S&P Global. Available at: https://www.spglobal.com

-

- UK Finance (2025). Digital Banking Report: Access and Distribution Models. London: UK Finance Publications. Available at: https://www.ukfinance.org.uk

-

- World Bank (2024). Financial Inclusion Report: Technology-Enabled Banking Access. Washington: World Bank Publications. Available at: https://www.worldbank.org