The payments landscape is undergoing its most significant transformation since the introduction of card schemes. Account-to-account (A2A) payments, powered by Open Banking infrastructure, are rapidly gaining ground against traditional card networks, promising lower costs, faster settlements, and new competitive dynamics that will reshape the financial services industry over the next decade.

The Scale of the A2A Revolution

The numbers tell a compelling story about A2A’s rise within the broader payments landscape. According to Juniper Research, global A2A payment transactions will surge from 60 billion in 2024 to 186 billion by 2029, a staggering 209% increase. [1]

To put this in context, the Capgemini World Payments Report 2025 projects that A2A instant payments will grow from 16% of all non-cash transaction volumes in 2023 to 22% by 2028, whilst card payments will decline from 57% to 50% during the same period.

This shift represents a fundamental rebalancing: A2A payments are expected to offset 15-25% of future card transaction growth, directly challenging the dominance of traditional card networks.

In the UK alone, Open Banking has already reached 15 million active users, with 22.1 million Open Banking payments processed monthly.[2]

This momentum shows no signs of slowing, with 93% of businesses believing that Open Banking adoption will continue to accelerate over the next five years. [3]

Remarkably, whilst only 22% of UK consumers are familiar with the term “Open Banking,” a Mastercard survey revealed that 70% are already connecting their financial accounts directly to tools that leverage this technology.[3] This disconnect between awareness and usage suggests that A2A payments are becoming embedded in consumers’ financial lives almost invisibly, a critical factor for mainstream adoption.

The Business Case: Where A2A Dominates

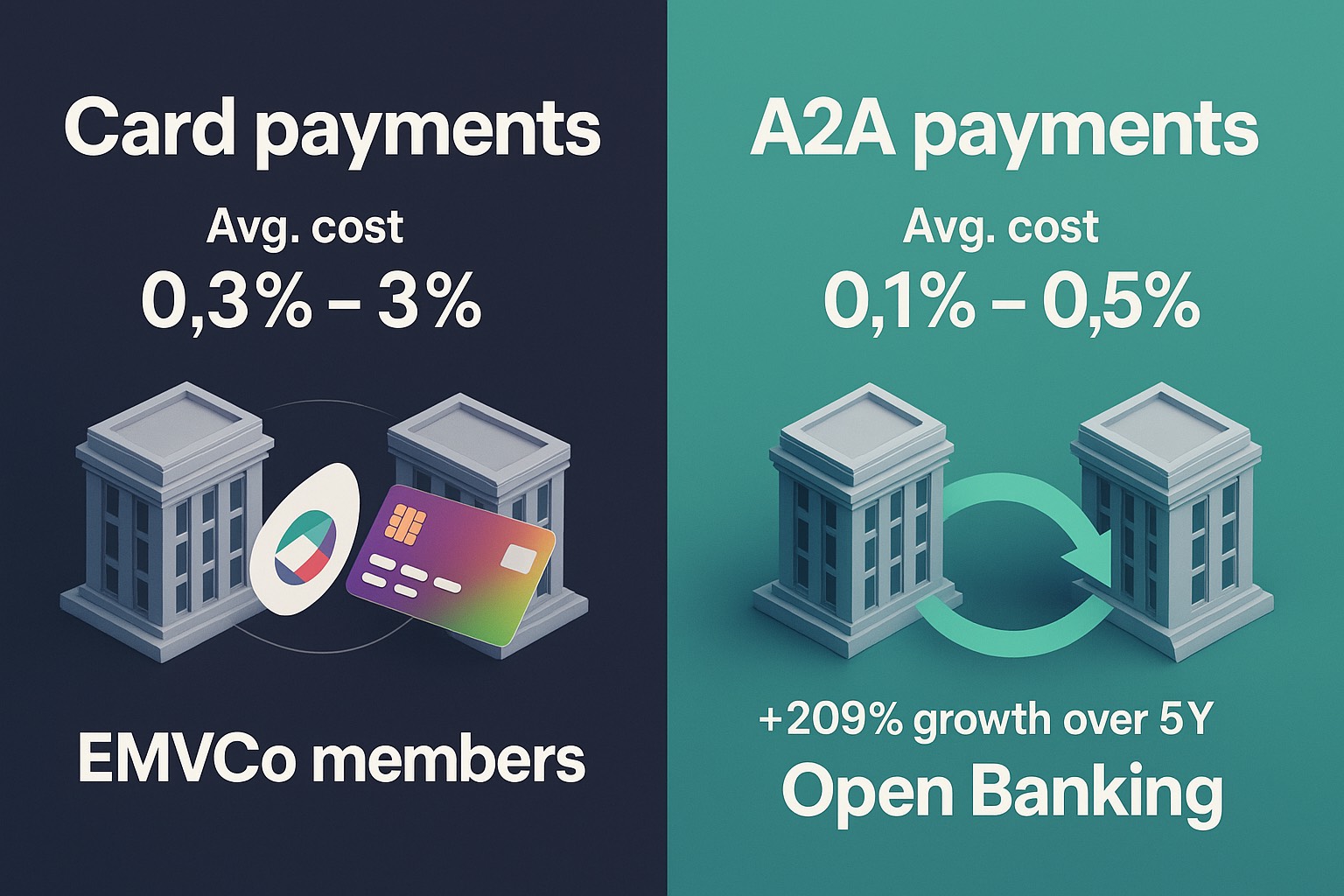

The appeal of A2A payments becomes immediately apparent when examining transaction economics. Traditional card payments incur interchange fees (capped at 0.2% for debit and 0.3% for credit in the UK/EU), scheme fees (0.05–0.15% plus per-transaction charges), and acquirer markups (0.2–1.0%), resulting in total costs of 0.3–3% depending on merchant size and card type.[4] By contrast, A2A payments typically cost between 0.1–0.5%, as they bypass card schemes entirely and utilise domestic instant payment rails such as the UK’s Faster Payments Service (FPS) or Europe’s SEPA Instant Credit Transfer.

Cost Component | Card Payments | A2A Payments |

Interchange Fees | 0.2% (debit) / 0.3% (credit) in UK/EU | None |

Scheme Fees | 0.05–0.15% plus per-transaction charges | None |

Acquirer Markups | 0.2–1.0% | Minimal processing fees |

Total Cost Range | 0.3–3% (varies by merchant size and card type) | 0.1–0.5% |

Payment Infrastructure | Card schemes (Visa, Mastercard) | Domestic instant payment rails (UK: FPS, EU: SEPA Instant Credit Transfer) |

Cost Structure | Multiple layers of fees (interchange + scheme + acquirer) | Bypasses card schemes entirely |

This cost advantage creates clear winners in specific use cases. One-off bill payments, utilities, telecommunications, and tax, represent A2A’s strongest position. HMRC tax payments and energy bills already predominantly use A2A in the UK, where the push payment model, instant settlement, and low fees make compelling sense for both billers and payers.

High-value retail transactions in sectors such as travel, automotive, electronics, and luxury goods also favour A2A. When a customer purchases a £5,000 holiday package, the merchant’s saving between a 2% card fee (£100) and a 0.3% A2A fee (£15) is substantial. Research indicates that 42% of UK consumers show intent to utilise Open Banking payments for in-store purchases, with 37% likely to make online payments this way.[5]

Peer-to-peer transfers represent A2A’s native use case, where bank-to-bank instant payments via FPS or SEPA Inst dominate entirely. Services such as Paym and similar platforms have made A2A the default for personal money transfers.

The Limitations: Where Cards Still Rule

Despite this progress, A2A payments face significant barriers in latency-sensitive environments. Public transport and ticket gates demand sub-300-millisecond response times with offline risk management capabilities, requirements that Strong Customer Authentication (SCA) through bank apps cannot meet. FPS typically requires 2–10 seconds, whilst SCT Inst has a 10-second SLA, making these rails fundamentally unsuitable for turnstile environments.

Supermarket point-of-sale presents similar challenges. Contactless card payments deliver sub-500-millisecond responses with global acceptance, whilst A2A currently requires phone app authentication with 5–20 second latency. The friction of A2A authentication at a checkout queue remains prohibitive, though future NFC-enabled Open Banking wallets could eventually change this dynamic.

Subscription and recurring payments reveal another A2A weakness. Whilst Variable Recurring Payments (VRPs) are gaining traction in the UK, cards benefit from mature stored credential frameworks, flexible recurring models, and automated retry logic. A2A lacks standardised recurring mandate user experiences, placing it at a structural disadvantage for subscriptions, at least for now.

Perhaps most critically, consumer protection remains a key differentiator. Card schemes provide formal chargeback processes and fraud liability frameworks with clear rules. A2A payments, being irrevocable once sent, offer limited consumer redress that depends on local banking law and merchant terms. This protection gap creates a higher trust barrier for consumers, particularly for unfamiliar merchants or disputed transactions.

Feature | Card Payments | A2A Payments |

Chargeback Process | Formal chargeback processes under scheme rules | No standardised chargeback; refunds are manual merchant-initiated credits |

Fraud Liability Framework | Clear fraud liability frameworks with established rules | Limited consumer redress; depends on local banking law and merchant terms |

Transaction Reversibility | Reversible through chargeback mechanisms | Irrevocable once sent |

Consumer Protection | Strong protections provided by card issuers and schemes | Less consistent; varies by jurisdiction and merchant agreement |

Trust Barrier | Lower trust barrier for consumers | Higher trust barrier, particularly for unfamiliar merchants or disputed transactions |

The Threat to Card Schemes

The strategic implications for Visa and Mastercard are profound. In Europe, card payments accounted for 70 billion transactions, 54% of all non-cash payments in 2023.[4] However, A2A’s lower cost structure is creating inexorable pressure, particularly as businesses seek to reduce payment acceptance costs.

Card schemes have built their business models on interchange and scheme fees that, whilst regulated in the UK and EU, still generate substantial revenues. As A2A solutions mature and user experience improves, the migration of transaction volume from cards to A2A will directly erode this fee income. The threat is most acute in the UK and Europe, where regulatory frameworks actively support Open Banking, but even card-dominated markets such as the United States are seeing change. The launch of FedNow in 2023, with an average transaction fee of just 4 cents compared to cards’ 3.5% per transaction, signals that A2A opportunities exist even in traditionally resistant markets.[1]

Variable Recurring Payments represent a particularly potent challenge. VRPs allow customers to connect authorised payment providers to their bank accounts, facilitating agreed recurring payments within set limits. This provides a service not easily replicable beyond A2A, offering increased flexibility and transparency compared to direct debit, and completely bypassing card rails.[1]

Predictions for the A2A Future

Looking ahead, several trends will define A2A’s trajectory:

Prediction 1: A2A will capture 30–40% of e-commerce transactions by 2030 in the UK and EU markets. As user experience friction reduces through pre-stored consents and improved checkout flows, the cost advantages will drive merchant adoption. However, cards will retain dominance in low-value, impulse purchases where convenience trumps cost.

Prediction 2: Variable Recurring Payments will achieve mainstream adoption by 2027, capturing 15–20% of the subscription market. The FCA and PSR’s commitment to developing VRPs, including the establishment of an independent company to drive this forward, signals regulatory support that will accelerate adoption.[6]

Prediction 3: A2A’s Achilles heel, consumer protection, will be addressed through industry-led frameworks by 2026. Without standardised dispute resolution mechanisms, A2A will struggle to achieve parity with cards for consumer trust. Forward-thinking banks and payment service providers will collaborate to create A2A-specific protection schemes.

Prediction 4: Cross-border A2A will remain limited until 2028, with SEPA providing regional coverage but global interoperability lagging. Cards will maintain their advantage in international transactions until payment rail interoperability improves significantly.

Prediction 5: Card schemes will respond with fee reductions and value-added services, attempting to justify their interchange by 2026. However, the fundamental economics favour A2A for many use cases, limiting the effectiveness of this strategy.

Implications for Digital Bank Expert’s Clients

For financial institutions, the A2A transition creates both opportunities and imperatives. Legacy core banking systems often struggle to support the real-time processing, API integrations, and instant settlement capabilities that Open Banking demands. Institutions that fail to modernise their infrastructure risk being unable to participate effectively in the A2A ecosystem, ceding ground to more agile competitors.

Digital Bank Expert’s core banking systems integration services become critical in this context, helping institutions enhance the agility, scalability, and compliance necessary to support rapid deployment of A2A solutions and real-time processing requirements. Similarly, strategic IT consulting services enable financial institutions to develop comprehensive roadmaps for A2A adoption, assessing current capabilities and positioning organisations to lead rather than follow in the payments revolution.

The transformation from card-dominated to A2A-inclusive payment ecosystems represents a fundamental shift in financial infrastructure, one that requires not merely technology updates but strategic reimagining of payment architectures. The institutions that invest now in modernisation will capture the opportunities that A2A presents; those that delay will find themselves increasingly marginalised in a rapidly evolving market.

Bibliography

- Bank for International Settlements (2024). Digital payments, informality and economic growth. BIS Working Papers No 1196.

https://www.bis.org/publ/work1196.htm - Bank for International Settlements (2024). Faster digital payments: global and regional perspectives. BIS Papers No 152.

https://www.bis.org/publ/bppdf/bispap152.pdf - Bank for International Settlements (2024). The organisation of digital payments in India – lessons from the Unified Payments Interface (UPI). BIS Papers No 152.

https://www.bis.org/publ/bppdf/bispap152_e_rh.pdf - European Central Bank (2025). Report on card schemes and processors. ECB Report. https://www.ecb.europa.eu/pub/pdf/other/ecb.reportcardschemes202502~1614226b0a.en.pdf

- FCA and PSR (2025). FCA and PSR set out next steps for open banking. Retrieved from https://www.fca.org.uk/news/statements/fca-and-psr-set-out-next-steps-open-banking

- Juniper Research (2024). Consumer A2A Payments – 186 Billion Transactions Globally by 2029. Retrieved from https://www.juniperresearch.com/press/pressreleasesconsumer-a2a-payments-186bn-transactions-globally-by-2029/

- Juniper Research (2024). Global A2A Payments Market: 2024-2029. Retrieved from https://www.juniperresearch.com/research/fintech-payments/emerging-payments/a2a-payments-research-report/

- Mastercard (2024). The acceleration of open banking in the UK. Retrieved from https://openbankingeu.mastercard.com/blog/the-acceleration-of-open-banking-in-the-uk/

- Open Banking Limited (2024). Open banking reaches 15 million UK users and 2 billion API Calls. Retrieved from https://www.openbanking.org.uk/

- The Pharmacy Show (2024). Open Banking payments adoption increasing amongst UK consumers. Retrieved from https://www.thepharmacyshow.co.uk/exhibitor-news-library/open-banking-payments-adoption-increasing-amongst-uk-consumers-zpnz