Our Expertise

Transforming Financial Institutions with AI-Driven Solutions

In today’s fast-evolving financial landscape, Artificial Intelligence (AI) is revolutionizing the way financial institutions operate. From enhancing customer service to optimizing risk management and improving operational efficiency, AI is driving innovation across the banking and financial services sector. Our AI-driven solutions are designed to help banks, payment processors, and fintech companies leverage cutting-edge technology to gain competitive advantages, improve decision-making, and deliver personalized experiences.

Why Artificial Intelligence Matters in Banking

AI technology allows financial institutions to process vast amounts of data, uncover insights, and automate tasks with unprecedented accuracy and efficiency. By integrating AI into your operations, you can:

- Enhance customer experience with personalized, real-time services.

- Streamline operations through automation and predictive analytics.

- Mitigate risks with AI-driven fraud detection and credit scoring models.

- Improve compliance by automating regulatory reporting and risk management.

Our AI Solutions for Financial Institutions

We provide custom AI solutions designed to help financial institutions harness the power of machine learning, predictive analytics, and natural language processing. Our AI solutions enable you to make better decisions, automate routine processes, and deliver enhanced customer experiences.

AI-Powered Customer Service and Chatbots

Transform customer interactions with AI-powered chatbots and virtual assistants. These tools provide customers with real-time, personalized support, reducing wait times and improving overall service quality. By integrating AI with your existing systems, chatbots can handle routine inquiries, assist with transactions, and provide tailored recommendations based on customer profiles.

Fraud Detection and Risk Management

AI’s ability to analyze large datasets in real-time makes it a powerful tool for detecting fraudulent transactions and managing risk. Our AI-driven systems continuously monitor and flag suspicious activity, helping your institution detect and prevent fraud before it impacts customers. Additionally, machine learning models help improve credit risk assessments, allowing for more accurate decision-making in lending.

Predictive Analytics for Business Insights

Our predictive analytics solutions enable financial institutions to anticipate market trends, customer behavior, and operational risks. With AI, you can make data-driven decisions to optimize product offerings, enhance customer engagement, and improve profitability. Predictive analytics also helps in identifying cross-sell and up-sell opportunities, increasing the lifetime value of your customers.

AI in Credit Risk Scoring

We leverage machine learning algorithms to enhance credit risk scoring models, providing more accurate predictions of borrower behavior and reducing the risk of default. By integrating real-time data from various sources, our AI-driven credit scoring systems enable financial institutions to make faster, more informed lending decisions while minimizing risk exposure.

Natural Language Processing (NLP) for Compliance and Reporting

AI-driven Natural Language Processing (NLP) tools can automate the analysis of large volumes of unstructured data, such as legal documents and regulatory reports. This allows financial institutions to streamline compliance reporting and monitor regulatory changes, reducing the burden on compliance teams while ensuring adherence to GDPR, AML, and other regulatory standards.

AI for Business Process Automation

Automate routine and labor-intensive tasks such as loan processing, customer onboarding, and transaction monitoring with our AI solutions. By eliminating manual processes, your institution can improve efficiency, reduce errors, and save on operational costs. Our AI-driven automation tools also ensure a higher degree of consistency and accuracy in daily banking operations.

Key Benefits of AI for Financial Institutions

Increased Efficiency

Automate routine tasks, streamline operations, and improve overall productivity with AI-powered solutions.

Enhanced Customer Experience

Deliver personalized, real-time banking services that enhance customer satisfaction and loyalty.

Improved Risk Management

Use AI to detect fraud, assess credit risk, and manage regulatory compliance in real-time, reducing exposure to financial risk.

Data-Driven Insights

Leverage predictive analytics and machine learning to make more informed business decisions, optimizing products and services.

Scalability and Flexibility

Our AI solutions are scalable and can be customized to meet the specific needs of your institution, allowing you to grow and adapt as the financial landscape evolves.

Our Expertise in AI for Banking

With a deep understanding of the financial services industry and years of experience in deploying AI-driven solutions, our team is well-equipped to help your institution capitalize on the benefits of artificial intelligence. From risk management to customer service automation, we design and implement AI solutions that are secure, scalable, and fully aligned with your business objectives.

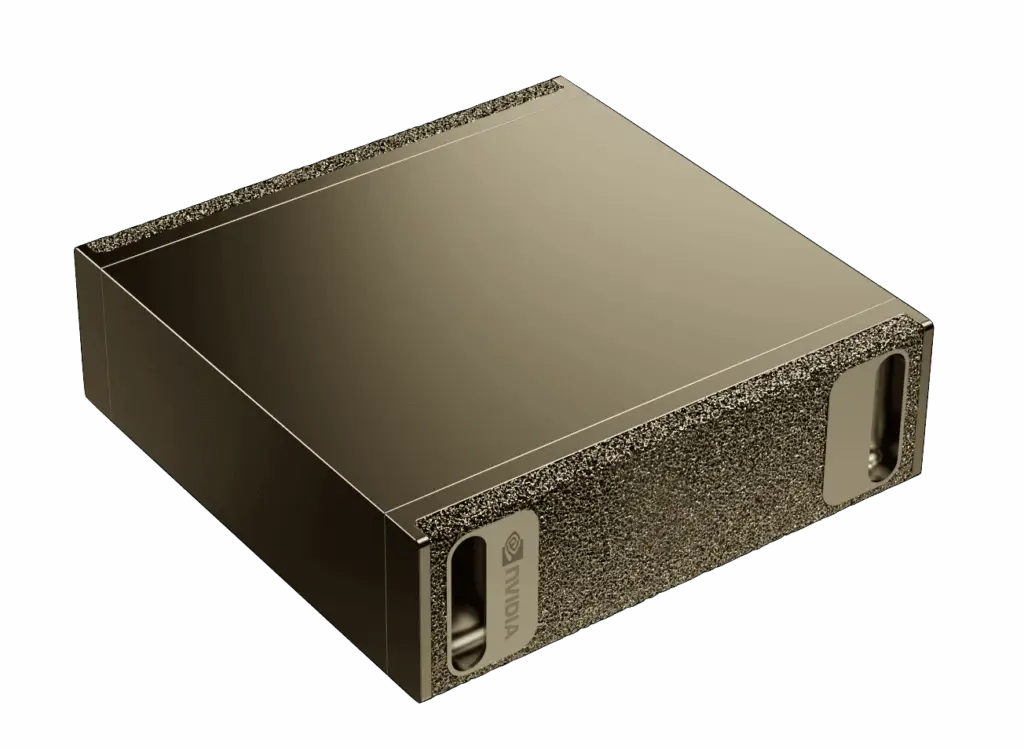

Backed by the power of the NVIDIA DGX Spark AI Supercomputer.

Partner with Us for AI-Powered Financial Solutions

As the banking industry becomes increasingly digital, embracing AI is essential for staying competitive. Our team is dedicated to helping financial institutions adopt AI technologies that drive innovation, improve customer engagement, and optimize operations.

Contact us today to learn how our AI solutions can transform your financial institution and deliver smarter, more efficient services.